As of late September 2025, Africa’s economy is still facing a number of problems, including as high inflation, unstable commodity prices, political unrest, and a lack of foreign reserves. Many currencies have been under pressure against the US dollar (USD) because of these things. This has made imports more expensive and made life more expensive for millions of people. Some countries, like Libya and Tunisia, have relatively strong currencies because they have a lot of oil and managed floats. But Sub-Saharan Africa has the weakest currencies on the continent.

List Of Top 10 Weakest Currencies In Africa 2025

1. São Tomé & Príncipe

Because São Tomé and Príncipe is an island nation, its economy is especially susceptible to fluctuations in the cost of imports, particularly those of food and fuel. When an economy is small, non-diversified, has low foreign exchange reserves, and has a high debt-to-GDP ratio, the currency associated with that economy remains at the bottom of the list.

2. Sierra Leone

Despite the fact that a currency redenomination will take place in 2022 (the old SLL will be replaced with the new SLE at a ratio of 1,000:1), the underlying economic instability and hyperinflationary pressures will continue unchanged. A significant dependence on resource exports, as well as heavy government expenditures despite minimal revenue collection, continue to contribute to the weakening of the leone.

3. Guinea

The mining industry (mostly bauxite and alumina) and commodity cycles are extremely important to Guinea’s economy. Investors and foreign exchange markets are occasionally frightened by political unpredictability and governance concerns. The purchasing power of the franc is diminished as a result of low foreign reserves in comparison to import requirements as well as inflationary pressures. It is possible that more mining investment could be beneficial to the franc; but, instability or low export prices continue to keep risk heightened.

4. Uganda

The Ugandan shilling is susceptible to being stressed by recurrent pressures from import demand (energy, capital goods), as well as periodic foreign exchange demand from significant projects (such as the expansion of the oil sector—for example). In spite of the fact that macro fundamentals (growth) are strong, the currency has been impacted by inflationary pressures and the need to import energy at various points in time. If oil output increases and foreign direct investment (FDI) flows increase, the shilling may strengthen; however, if neither of these things occurs, it will continue to be susceptible to shocks from the outside world.

5. Burundi

Burundi is one of the less developed and less diverse economies in Africa. It has a limited potential for exporting goods and a modest amount of reserves. In reaction to foreign exchange stress, policy solutions are limited due to political instability and limited fiscal space. The franc is a weak unit due to it having limited reserves and having experienced high inflation episodes in the past. Without significant inflows of donors or expansion of exports, structural constraints will not provide much respite in the near future.

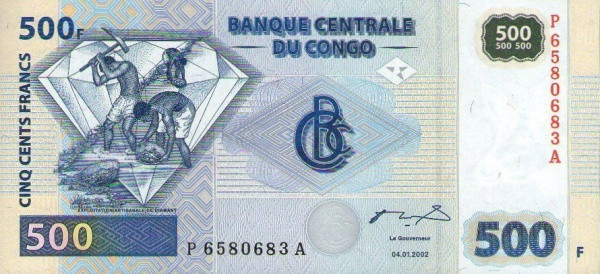

6. DRC

Because of bottlenecks in revenue collection, governance, and infrastructure, the Democratic Republic of the Congo’s currency continues to be weak. This is due to the fact that the country’s substantial mineral wealth is not being converted into stable foreign exchange reserves. In addition, the franc is subject to pressure from political concerns and periodic capital flight. Mining contracts that are improved and fiscal management that is improved could be of assistance; but, instability is likely to continue until governance is improved.

7. Tanzania

Tanzania has plans to invest in infrastructure and has relatively substantial import requirements, both of which contribute to an increase in the demand for foreign currency. It is possible that inflation and periodic balance-of-payments difficulties will continue to put pressure on the shilling, despite the fact that growth has been strong. But the currency is susceptible to the need for dollars from outside sources, despite the fact that continued tourism and export expansion (minerals, agriculture) provide support.

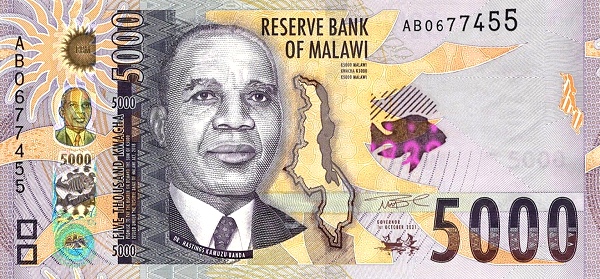

8. Malawi

In the years 2024 and 2025, Malawi dealt with severe inflation and shortages of foreign currency. Additionally, the country’s public debt and depleting reserves made it more vulnerable. The confidence in the kwacha was further damaged by the domestic instability that was caused by inflation and shortages respectively. Restoring reserves and drawing dollar inflows from agriculture, mining, and aid are essential to the recovery process; yet, political shifts make the route forward uncertain but necessary.

9. Nigeria

The naira has been under pressure as a result of adjustments to the country’s subsidies, inflation, and shortages of foreign currency. Multiple exchange-rate windows, including official, investor, and parallel/black market exchanges, contribute to fragmentation and result in a lower naira in many transactions. Oil export cycles and government policy (devaluations, interventions by the central bank) are the primary factors that influence the movement of the naira. Recent policy initiatives (rate reduction, reforms) and actions taken by the central bank have the potential to stabilize the naira; yet, structural dependence on oil and the segmentation of the foreign exchange market keep risks elevated.

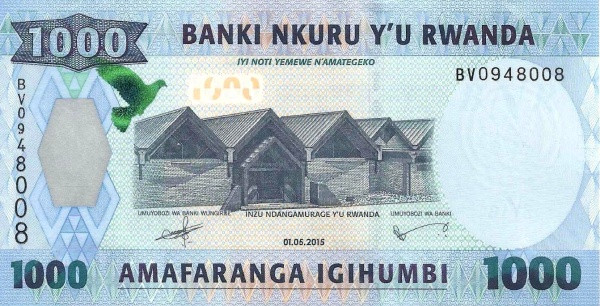

10. Rwanda

When measured against the United States Dollar, the Rwandan franc is numerically lower per unit than other African currencies. Rwanda’s small economy and import demands (fuel, capital goods) provide foreign exchange demand that keeps the franc at a modest value per USD. Despite the fact that Rwanda has achieved excellent growth and investment, the franc remains at a modest value. Despite the fact that the franc continues to be supported by excellent governance and export diversification, it is still a small-unit currency (that is, many RWF are equivalent to one USD).