By 2025, millions of people worldwide rely on mobile banking apps as their main interface for managing their finances, making them more than just a convenience. The top apps in this quickly changing market offer more than just simple transactions; they also offer strong security, user-friendly interfaces, AI-powered hyper-personalization, and a range of value-added services that enable users to fully manage their financial lives. There is intense competition between nimble fintech startups and well-established traditional institutions. In light of their features, user interface, and security advancements, here are a few of the leading candidates for the top mobile banking apps globally by 2025:

List Of Top 10 Best Mobile Banking Apps In The World 2025

1. Capital One Mobile

As of 2025, the Capital One Mobile app is still a formidable competitor in the cutthroat world of online banking, regularly commended for its user-friendly interface, strong security features, and extensive toolkit that enables users to effortlessly handle their money. Millions of users worldwide view it as more than just an app; it’s a daily financial companion that makes complicated activities easier and gives them intelligent financial control.

2. Chase Mobile

In the year 2025, the Chase Mobile® app continues to firmly establish itself as a dominant force in the realm of digital banking. In the eyes of millions of consumers, it is much more than just a tool for checking balances; rather, it is a comprehensive financial hub that blends daily banking, credit card management, investment information, and a strong emphasis on security and user control in a seamless manner. Chase, which is one of the largest banks in the United States, makes use of its considerable resources to provide a mobile experience that is comparable to and frequently exceeds that of many competitors who are solely focused on creating financial technology.

3. Quontic Bank

In the ever-changing environment of the banking industry in 2025, Quontic Bank continues to distinguish itself not only as an online bank but also as a “Adaptive Digital Bank” with a goal that is clearly focused on people. Quontic has carved itself a distinct niche by combining competitive digital goods with a profound commitment to financial inclusion and community development. This is in contrast to larger financial institutions, who claim massive customer bases. This financial organisation which has its headquarters in New York is demonstrating that it is possible for a bank to be both technologically sophisticated and socially responsible.

4. Varo Bank: Mobile Banking

By the year 2025, Varo Bank has established itself as a convincing demonstration of the power of mobile-first banking, particularly for the millions of people in the United States who are working towards achieving financial security. Varo is a fully-fledged, FDIC-insured bank that was developed from the ground up for the digital age. It provides a hassle-free and fee-friendly service that can be accessed immediately from your smartphone. Varo was the first consumer fintech company in the United States to obtain a national bank charter. A primary focus of Varo’s purpose is to expand access to financial services. In order to better serve the average American, particularly those who are living pay cheque to pay cheque, it is designed to offer banking solutions that are easily accessible, efficient, and cost-effective. These solutions are designed to solve common financial pain points.

5. Wells Fargo Mobile

In the year 2025, the Wells Fargo Mobile® app serves as a powerful and indispensable digital front door for millions of the company’s customers. It provides a comprehensive suite of banking, credit, and investment management features that can be accessed straight from the customers’ smartphones. Wells Fargo, which is one of the largest financial institutions in the United States, continues to make significant investments in its mobile platform. The company’s goal is to create a mobile banking experience that is user-friendly, safe, and packed with features that can accommodate the continually growing requirements of modern banking.

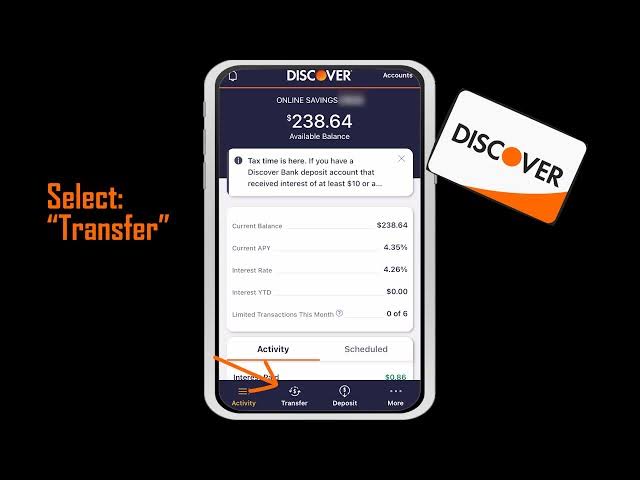

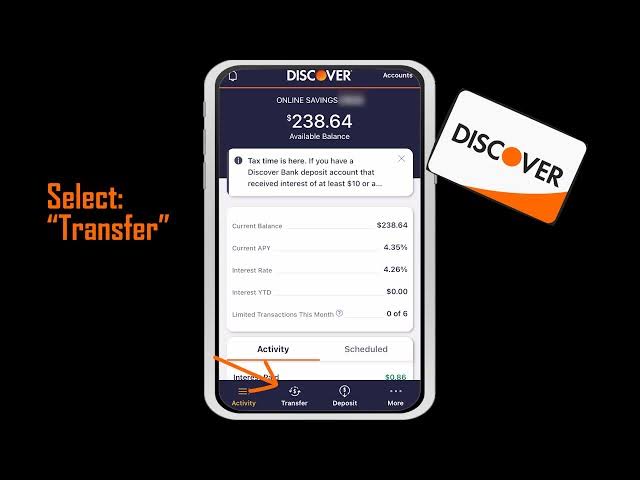

6. Discover Mobile

The Discover Mobile app continues to stand out in the competitive digital banking industry in the year 2025. It has received excellent praises for its user-friendly interface, comprehensive features, and persistent commitment to the safety and rewards of its customers. Users of the app’s credit cards, bank account users, and loan clients have access to a highly efficient and handy centre that allows them to manage their financial lives from any location without having to leave their homes. Throughout its history, Discover has placed a significant emphasis on the digital experience. In the year 2025, the company’s mobile app reflects this commitment, giving it an excellent option for individuals who want to manage their finances primarily through their mobile device, such as a smartphone or tablet.

7. Ally Bank

Ally Bank continues to consolidate its status as a leading all-digital bank in the year 2025. The bank is routinely recognised for its highly competitive interest rates, minimum fees, and an exceptional client experience that is offered totally online and through its mobile app that has won multiple awards. Ally is a tremendous monument to the success of branchless banking, having shed its heritage as GMAC and adopted a totally digital strategy. It has passed cost savings directly to its 3.3 million clients in the form of greater returns and new features. Ally is a powerful example of the success of branchless banking.

8. First Foundation Bank Mobile

When the year 2025 rolls around, the First Foundation Bank (FFB) Mobile app has proven itself to be a powerful and perceptive instrument. It differentiates itself from other banking applications by providing not just the conventional banking operations but also a comprehensive suite of features that are designed to improve the overall financial health of its customers. The FFB Mobile app, which is powered by MX, a leading financial data platform, is designed to provide a comprehensive perspective of a user’s economic situation, thereby assisting the user in tracking their progress and making informed decisions regarding their finances while doing so. With a history that can be traced back to a combination of banking and wealth management services, First Foundation Bank gives a fresh perspective to the digital offering that it provides. Through the use of the app, the company demonstrates its dedication to provide complete financial services as well as a personalised, community-bank grade of service.

9. LendingClub

Having successfully evolved from its peer-to-peer lending origins into a full-spectrum financial institution with its acquisition of Radius Bank, LendingClub has firmly established itself as the largest digital marketplace bank in the United States of America in the year 2025. Because of this strategic move, which was finished in 2021, LendingClub is now able to provide its members with a more comprehensive financial ecosystem by offering a greater variety of goods and services across a wider range of categories. In the year 2025, the business model that LendingClub employs is one of a kind since it combines a reliable lending marketplace with a bank balance sheet. Because of this, they are able to finance loans through direct deposits as well as sales to a diversified network of investors, which includes financial institutions such as banks and credit unions as well as asset managers. This hybrid model tries to generate compelling risk-adjusted returns for investors while simultaneously lowering the price of borrowing money for people who are making purchases.

10. SoFi

In the year 2025, SoFi Technologies, Inc. (SoFi) has firmly established itself as a genuine “one-stop shop” for digital financial services. This is accomplished by integrating borrowing, saving, spending, investing, and protecting money all within a single platform that is user-friendly. Having obtained a national bank charter in 2022, SoFi combines the adaptability and innovation of a fintech company with the stability and trustworthiness of a regulated bank. This potent combination has resulted in SoFi’s remarkable development and solidified its position as a leader in the ever-changing financial scene. The objective of SoFi, which is to assist its members in achieving financial independence, is at the centre of the company’s strategy. A “Financial Services Productivity Loop” (FSPL) is the engine that propels this purpose. This loop is a positive feedback loop in which recruiting new members results in those members adopting numerous products, which in turn fuels growth and profitability. Clearly, this method is proving to be successful.