Innovative developments in artificial intelligence (AI), blockchain technology, embedded finance, and digital currencies are driving the continued rapid evolution of the financial technology (Fintech) sector. A select group of visionary thinkers, entrepreneurs, and commentators are guiding this transformation. Their insights shape the discourse and direction of the industry, and they are an integral part of this transformation. As of the year 2025, these individuals are not merely observers; rather, they are active participants who can be found leading companies, providing advice to governments, and educating the general public about the future of finance.

List Of Top 10 Best Fintech Influencers In The World 2025

1. Vitalik Buterin

There isn’t much to say about Vitalik Buterin. He helped create Ethereum, and his work has been important in making blockchain technology more than just a way to send and receive cryptocurrency. It is now a platform for decentralised applications (dApps) and decentralised finance (DeFi). In 2025, Buterin is still a key player in conversations about Ethereum’s scalability (through Ethereum 2.0 and Layer-2 solutions), the philosophical foundations of decentralisation, and the social effects of blockchain. He is known for his thoughtful critiques of centralisation in the crypto space and for pushing for real decentralisation to keep users safe and stop hidden vulnerabilities. His impact goes beyond the crypto community; it affects how governments and traditional financial institutions view and use distributed ledger technology.

2. Antonio Grasso

Antonio Grasso is a top global B2B influencer and a master of digital transformation. He is the founder and CEO of Digital Business Innovation Srl, and he always has deep insights into how AI, blockchain, cybersecurity, and the Internet of Things (IoT) are coming together. Grasso’s main concern in 2025 is still the ethical and social effects of Generative AI. He talks about how it could change many industries but warns about privacy and individuality. His long history in IT and his role as an accredited global mentor for startups make him a key voice for businesses that are trying to adapt to new technologies and come up with new ideas in an ethical way.

3. Mike Quindazzi

Mike Quindazzi is a Managing Director and U.S. Digital Alliances Leader at PwC. He is a strong supporter of new technologies and digital transformation. He has worked as a management consultant for more than 30 years and is a very popular keynote speaker on global mega-trends. In 2025, Quindazzi keeps talking about how the Artificial Intelligence software market is growing at an exponential rate and how technologies like augmented reality (AR), robotics, and blockchain are changing business and society as a whole. He is an invaluable resource for businesses that want to innovate and change because he can turn complicated technological advances into useful plans.

4. Spiros Margaris

There is a good reason why Spiros Margaris is always at the top of the list of the best Fintech and AI influencers in the world. He is a venture capitalist and advisor to many “unicorn” Fintech companies. He has a unique mix of investment knowledge and the ability to see how technology is changing. In 2025, Margaris’s power comes from his sharp analysis of how AI and Fintech are changing financial services, from making things more automated and accessible to creating new products. He is a well-known speaker on how Fintech can help society and the moral issues that come up as AI becomes more common in finance. He gives organisations useful information on how to succeed in a changing financial world.

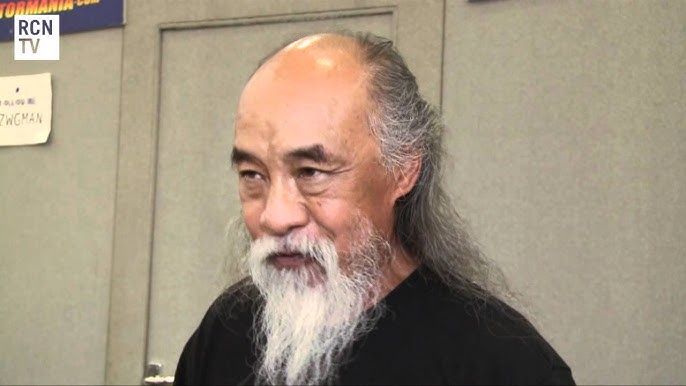

5. Al Leong

Al Leong is a thought leader, board advisor, and award-winning marketing executive who is very involved in the blockchain, Web3, and decentralised finance (DeFi) space. Leong’s influence is clear in 2025, when he gives companies strategic advice on how to deal with the complicated issues of Web3 infrastructure, staking, decentralised exchanges (DEXs), and regulatory technology (Regtech). He has led rebranding efforts for top Web3 companies and grown blockchain consulting firms. He takes a practical, results-oriented approach to getting people to use these game-changing technologies. His recent win of the 2025 Excellence in Marketing Leadership and Innovation Award shows how much he has done to move the industry forward.

6. Jim Marous

Jim Marous is a leading expert on digital banking trends, customer experience, and marketing in financial services. He is the co-publisher of The Financial Brand and The Digital Banking Report. In 2025, Marous is still going against the grain of traditional banking. He is pushing for a move towards “cognitive banking,” which uses customer data and AI to give people truly personalised and proactive financial advice. His insights stress the importance of banks and credit unions going beyond just having a digital presence and making digital interactions more human. This makes him an important voice for banks and credit unions that want to build stronger relationships with customers and compete well in a future driven by AI.

7. Chris Gledhill

Chris Gledhill is a world-famous expert on Fintech. He is known for his work to question the rules of traditional banking and imagine a fully digital banking system for the 21st century. Gledhill’s forward-thinking ideas are based on real-world experience as the former Head of Innovation at Lloyds Banking Group and CEO of UK Challenger Bank Secco. In 2025, people are still talking about him when they talk about the future of challenger banks, the role of AI, blockchain, and biometrics in financial services, and the need for consumerization in enterprise technology. He is still on a mission to change the finance industry by pushing for approaches that put the user first and use technology.

8. Michael Kitces

Michael Kitces is a Certified Financial Planner (CFP) and the publisher of the popular blog “Nerd’s Eye View.” He is an expert on both financial planning technology and advisor Fintech. Kitces’s in-depth look at how technology is changing the financial advisory field in 2025 is very helpful. His research, which includes the well-known “Kitces Report,” points out important changes, such as the growing focus on collaborative planning, the ongoing use of virtual meetings, and the role of full-service planning software in making workflows more efficient. He helps financial advisors use technology to make their work more efficient, engaging, and focused on providing value to their clients.

9. Brett King

Brett King is the face of the future of banking. As the founder of Moven and host of “Breaking Banks,” the world’s number one Fintech podcast, his idea of “Bank 4.0″—banking in a world with AI and augmented reality—continues to shape the industry. King’s insights in 2025 are mostly about how traditional banks are dealing with more and more pressure from Fintech disruptors, Big Tech, and changing rules and regulations. He is a well-known voice on the rise of Banking-as-a-Service (BaaS), embedded finance, and how AI-driven services are changing the way financial products are delivered and used. He tells banks that they need to make big changes to stay relevant.

10. Andreas Staub

Through the lens of behavioural economics, Andreas Staub gives a unique view of the Fintech world. As a key person at FehrAdvice & Partners, he stresses that the core of Fintech and Insurtech isn’t just about technology; it’s also about how people act, their culture, their mindsets, and how things change. In 2025, Staub’s influence comes from his work to get people to see social preferences, trust, fairness, and reciprocity as important factors that can help businesses stand out and make money in the digital financial world. He says that successful Fintechs add social value and that the disruption that is often talked about ends up in forms of cooperation, which makes human-centered approaches more sustainable than technology alone.

ztmyyo

7otxfi

F*ckin’ remarkable things here. I’m very glad to see your post. Thanks a lot and i am looking forward to contact you. Will you kindly drop me a mail?